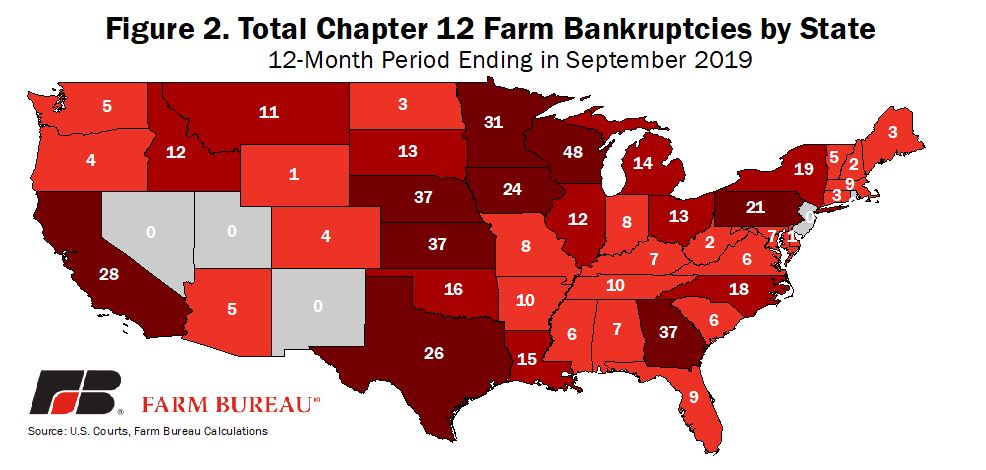

The Agriculture Department currently projects farm income in 2019 to reach $88 billion – the highest net farm income since 2014’s $92 billion, but still 29% below 2013’s record high. In addition, nearly 40% of that income – some $33 billion in total – is related to trade assistance, disaster assistance, the farm bill and insurance indemnities and has yet to be fully received by farmers and ranchers.

Moreover, farm debt in 2019 is projected to be a record-high $416 billion, with $257 billion in real estate debt and $159 billion in non-real estate debt. The repayment terms on this debt, according to data from the Kansas City Federal Reserve, reached all-time highs for a variety of categories. All non-real estate loans saw an average maturity of 15.4 months, feeder livestock had an average maturity period of 13 months, other livestock had a maturity period of 18 months and other operating expenses, i.e., loans primarily for crop production expenses and the care of feeding livestock, had an average maturity period of 11.5 months – all record-highs. Put simply, farmers are taking longer to service their debt – a trend made easier due to historically low interest rates.

Read more from AFBF Market Intel