This article is an update to a previous Market Intel that was posted, changes made to the previous article will be in strikethrough and bold. American Farm Bureau Federation and state Farm Bureau presidents held a call with officials at USDA ; these changes reflect discussions held on that call.

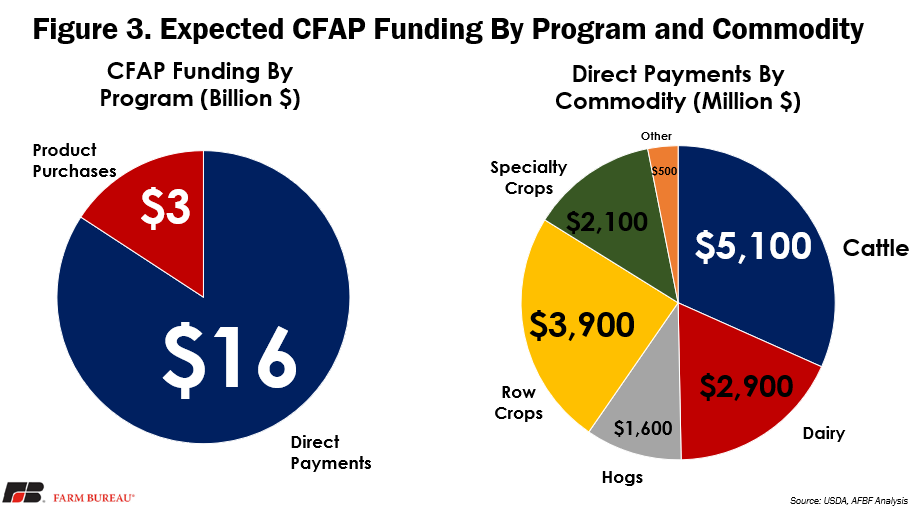

To provide immediate financial assistance to farmers and ranchers impacted by COVID-19, e.g., Coronavirus Sends Crop and Livestock Prices into a Tailspin and Pandemic Injects Volatility into Cattle and Beef Markets, the Coronavirus Aid, Relief, and Economic Security Act provided the secretary of Agriculture with an immediate $9.5 billion and the Commodity Credit Corporation with a $14 billion replenishment, which will be available in July (What’s in the CARES Act for Food and Agriculture). On April 17, USDA unveiled details of the much-anticipated CARES Act assistance package for agriculture, which includes $16 billion in direct payments to farmers and ranchers and $3 billion in food product purchases for distribution.

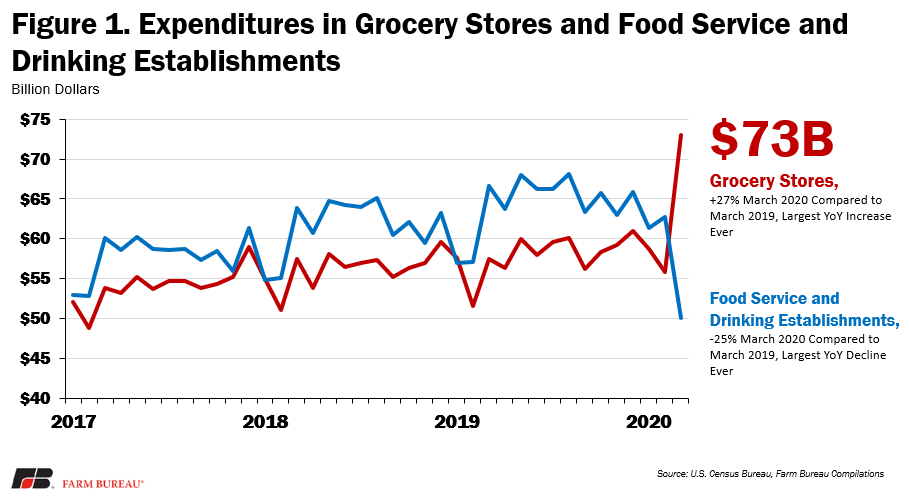

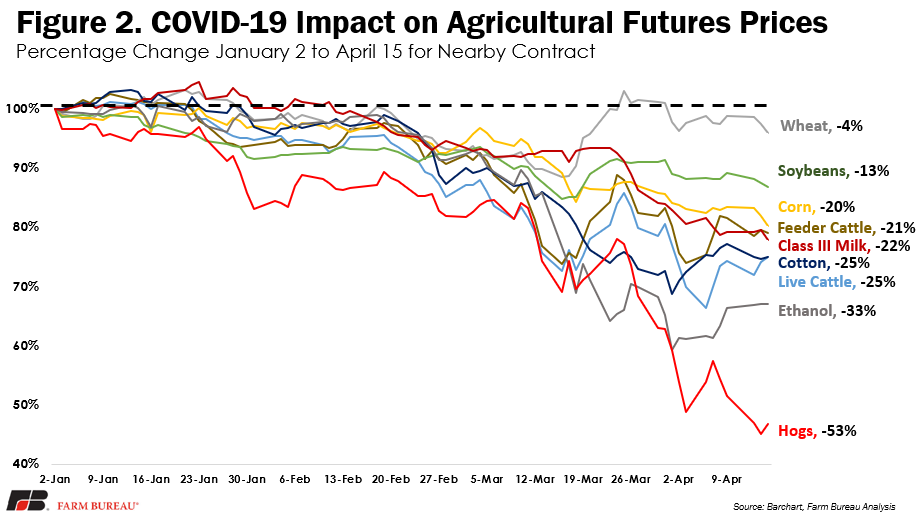

Commodity prices across the board have been significantly impacted as a result of the economic consequences of social distancing and the closing of non-essential businesses, especially the full or partial shuttering of the retail, food service and restaurant sectors. For example, during March, Census Bureau data revealed that in-store clothing sales – impacting demand for cotton – had fallen by 50%. Additionally, grocery store sales were at a record $73 billion, while sales in food service and drinking establishments declined by 25% year-over-year to $50 billion, Figure 1.

Direct Payments to Producers

The Coronavirus Food Assistance Program, crafted using funding in the CARES Act, is made of two components: direct payments to farmers and ranchers totaling $16 billion, and $3 billion in food product purchases for distribution.

The direct payments will financially assist producers with additional adjustment and marketing costs resulting from lost demand due to COVID-19. The payments will be coupled to actual production and based on actual losses agricultural producers experienced in response to price declines and supply chain disruptions, i.e., sales of commodities impacted by COVID-19. To qualify for a payment, a commodity must have declined in price by at least 5% between January and April. As Figure 1 demonstrates, most agricultural products have quite easily qualified at this threshold.

Of the $16 billion provided for direct payments to producers, it’s been reported that $9.6 billion is directed toward the livestock industry, e.g., cattle, dairy and hogs; $3.9 billion is for producers of row crops, such as cotton; $2.1 billion is for specialty crop producers; and $500 million is for other crops. USDA has yet to confirm this distribution of funding. While these “buckets” of money are current estimates of what may be needed for each industry, if one “bucket” needs less, USDA will still be able to move money between “buckets” to ensure the funds get to where they are needed.

USDA has disclosed the payments are determined using two calculations. One part of the payment will be determined from price losses that occurred January 1 through approximately April 15-17 (no final date confirmed by department); Producers will be compensated for 85% of the price loss during that period. The other part of the payment calculation is derived from losses from April 15-17 through the next two quarters, for which producers will be compensated 30% of expected losses.

There is still some confusion around what price series will be used for each commodity in the calculation of payments. USDA has indicated that they will utilize the most reflective price series for each commodity. Unfortunately, not all products have a usable price series for USDA to work with, but there will be an opportunity for specialty categories to demonstrate losses to the Agricultural Marketing Service or Farm Service Agency, a process that will be specified in rulemaking.

Additionally, there is concern around coverage for domestic aquaculture production. The Commerce Department has been provided $300 million to support seafood and aquaculture, however, it is unclear to whether this will cover domestic aquaculture, as opposed to international fishing, at all and, if it is covered, to what extent. USDA will be in close communication with the Commerce Department regarding this issue. As it currently stands, it is uncertain where or how domestic aquaculture will be covered, although USDA has indicated a desire to see it receive funds.

Since the length of enforced social distancing measures remains to be seen, there will be some self-certification of losses, so producers will need to save records and paperwork to demonstrate losses. This is particularly true for producers who are being forced to depopulate livestock or forced to destroy their product (i.e., dumping milk, plowing under specialty crops) as CFAP payments are expected to help to partially offset these losses.

In the dumped milk example, it is not expected that producers will be compensated for the full value of the dumped milk, but the milk that is produced and dumped will still be eligible for the payment rate that milk receives under the direct payment program (i.e., 85% of the price drop from January to April). CFAP funds will not be used to pay for depopulated livestock. Additionally, the funds are intended to cover producers who own the commodity or product, so animals raised under contract (i.e., poultry grown under contract for an integrator) are not expected to be covered.

USDA has set a goal to distribute payments in May. Payment limits still apply, set at $125,000 per commodity with an overall limit of $250,000 per individual or entity. Additionally, USDA has indicated that CFAP may take into consideration other farm program benefits, which could limit some CFAP payments to prevent farmers from being paid more across multiple farm programs. Participation in other farm programs such as Agriculture Risk Coverage, Price Loss Coverage, Dairy Margin Coverage and Dairy Revenue Protection is complementary to CFAP and will not lower a recipient’s CFAP payments.

Product Purchase Program

USDA will partner with regional and local food distributors in areas where the workforce has been significantly impacted by the closure of many restaurants, hotels, and other food service entities to purchase $3 billion in fresh produce, dairy and meat. USDA will start by buying an estimated $100 million per month in fresh fruits and vegetables, $100 million per month in a variety of dairy products, and $100 million per month in meat products.

The distributors and wholesalers will then provide a pre-approved box of fresh produce, dairy and meat products to food banks, community and faith- based organizations, and other non-profits serving Americans in need.

On Tuesday, USDA will host a webinar outlining how interested parties can submit proposals to help the agency purchase and distribute these agricultural products. The agency indicated it will be accepting proposals in the next two weeks.

In addition to the $3 billion, USDA announced it would use other available funding sources to purchase and distribute food. USDA still has up to $873.3 million available in Section 32 funding to purchase a variety of agricultural products for distribution to food banks. USDA has indicated that the use of these funds will be determined by a mix of industry requests, USDA analysis and food bank needs. Additionally, the Families First Coronavirus Response Act and the CARES Act provided another $850 million for food bank administrative costs and USDA procure, of which at least $600 million must be food purchases.

Summary

The Coronavirus Food Assistance Program helps provide immediate support to farmers, ranchers and agribusinesses struggling under the immense weight of the COVID-19 impact. While the details of this package are still not fully known, the $16 billion in direct support to livestock, specialty and non-specialty crops will help to offset COVID-19-related losses as well as $3 billion in commodity purchases

While the package was designed to be all inclusive, not all of the many industries damaged by this pandemic were directly identified for support. For example, livestock sectors such as poultry, sheep and lamb, as well as specialty livestock such as mink, or horticultural producers were not directly referenced in the CFAP package. Rest assured, there will be an opportunity for specialty categories to demonstrate losses to AMS or FSA and receive CFAP support, and USDA has indicated its desire and willingness to cover these products if possible. The ethanol industry is also not expected to will not receive financial support in the current CFAP package. While direct payments to corn producers will help, ethanol supplies that far exceed demand and impending storage capacity constraints will continue to weigh down corn demand and cash corn prices.

While this program is an important down payment in making agriculture whole from the unprecedented and unexpected economic fallout related to COVID-19, more help will be needed as the full extent of the crisis becomes known. To that end, USDA will see the Commodity Credit Corporation replenished by $14 billion in July but more funding will likely be needed.

Contact:

Michael Nepveux

Economist

(202) 406-3623

michaeln@fb.org

twitter.com/@NepveuxMichael

John Newton, Ph.D.

Chief Economist

(202) 406-3729

jnewton@fb.org

twitter.com/@New10_AgEcon